Get Home Loan Starting @ 6.50% p.a.

Looking for home loan rates of all banks in India? If yes then your search ends here. Check and compare the current housing loan interest rates in the below-given chart.

Housing Loan Interest Rate of All Banks in 2022

| Banks/Lenders | Interest Rate (p.a) | Processing Fees |

| HSBC Bank | 6.64% | 1% (Rs. 10,000) |

| Kotak Mahindra Bank | 6.65% | 0.50% |

| Saraswat Bank Home Loan | 6.70% | Nil |

| State Bank of India | 6.75% | 0% – 0.35% |

| Citibank | 6.75% | Rs. 10,000 |

| HDFC LTD | 6.75% | Rs. 3,000 – Rs. 4,500 |

| Bajaj Finserv | 6.75% | Up to 6% of loan amount |

| Bank of Baroda | 6.75% | Rs. 8,500 – Rs. 25,000 |

| Union Bank of India | 6.80% | — |

| Punjab and Sind Bank | 6.85% | Full Waiver |

| Bank of India | 6.85% | Rs. 1,500 – Rs. 20,000 |

| Central Bank of India | 6.85% | Rs. 20,000 |

| Tata Capital Housing Finance | 6.90% | 0.50% |

| Axis Bank | 6.90% | Rs. 10,000 |

| IDFC First Bank | 6.90% | Rs. 5,000 – Rs. 5,000 |

| UCO Bank | 6.90% | 0.15% (Rs. 1,500 – Rs. 15,000) |

| ICICI Bank | 6.90% | Rs. 3,000 |

| LIC Housing Finance | 6.90% | Rs. 10,000 -Rs. 15,000 |

| Canara Bank | 6.90% | Rs. 1,500 – Rs. 10,000 |

| Bank of Maharashtra | 6.40% | Rs. 10,000 |

| Sundaram Home Finance | 6.95% | Rs.3,000 (for salaried) |

| IDBI Bank | 6.95% | 0.50% (Rs. 2,500 – Rs.5,000) |

| Punjab National Bank | 6.95% | 0.35% (Max Rs. 15,000) |

| Indian Overseas Bank | 7.05% | 0.50% (Max Rs. 20,000) |

| Jammu and Kashmir Bank | 7.20% | Rs. 500 – Rs. 10,000 |

| Karur Vysya Bank | 7.20% | Rs. 5,000 |

| DBS Bank | 7.30% | 0.25% (Rs. 10,000) |

| PNB Housing Finance | 7.35% | 0.25% – 0.50% (Rs. 10,000) |

| GIC Housing Finance | 7.45% | Rs. 2,500 |

| Karnataka Bank | 7.50% | Rs. 250 |

| Federal Bank | 7.65% | Rs. 3,000 – Rs. 7,500 |

| South Indian Bank | 7.85% | 0.50% (Rs. 5,000 – Rs. 10,000) |

| Dhanlaxmi Bank | 7.85% | Rs. 10,000 |

| Standard Chartered Bank | 7.99% | 1% |

| Aavas Financiers | 8.00% | 1.00% |

| United Bank of India | 8.00% | 0.59% (Rs. 1,180 – Rs. 11,800) |

| Tamilnad Mercantile Bank | 8.25% | Rs. 15,000 |

| Bandhan Bank | 8.50% | 1% (Rs.5,000) |

| Indiabulls Housing Finance | 8.65% | 2% |

| DHFL Housing Finance | 8.75% | Rs. 2500 |

| Shriram Housing Finance | 8.90% | NA |

| Yes Bank | 8.95% | 1% (Rs. 10,000) |

| Aditya Birla Housing Finance Ltd. | 9.00% | 1% |

| Hudco Home Loan | 9.45% | NA |

| Reliance Home Finance | 9.75% | Rs. 3,000 – Rs. 6,500 |

| IIFL | 10.50% | 1.25% |

| India Shelter Finance Corp. Ltd. | 12.00% | 2.00% |

- Housing loan interest rates for all banks/lenders in the table are mentioned as of 28th July 2021.

- Home loan interest rates in the table are subject to change anytime without prior notice.

- Home loan interest rates in the table are subject to the credit/risk profile as assessed by the lender/bank on the basis of parameters such as CIBIL score, age, source of income, and repayment capacity of the applicant.

About Housing Loan and Interest Rates

Everyone dreams of their own home. Due to the skyrocketing inflation in the real estate sector, many people’s dream remains only a dream. Even working people don’t have sufficient funds to purchase a home or an apartment. Home loans or housing loans provide a wonderful opportunity to a person who wants to purchase a home.

If interested, you can also fulfill your dream of owning a home by taking the advantage of housing loans from Indian banks and financial institutions. But before applying for a home loan you must have an idea about current housing loan interest rates.

There are several banks and finance housing finance companies in India that are providing home loan facilities. Different lenders have different interest rates on their housing loans. It is recommended to check and compare the home loans from different banks and housing finance companies before making any final decision. The interest rate on a home loan can vary in the same bank because of your credit score.

Buying a new home can be one of the biggest events of everyone’s life. If you are thinking about getting a home with a home loan facility then you should take this decision very carefully. You must analyze your income sources and repayment capacity. However, no lenders will provide you with the loan without verifying your credit score, income sources, and capacity.

Types of Housing Loan Interest Rates

Basically, there are two types of home loan interest rates charged by most Indian banks and housing finance companies.

1. Fixed Interest Rate

If you opt for the fixed interest rate on your home loan then the rate of interest will remain the same through the loan tenor. In this system, your home loan interest rate is a shield, and hence frequent rate fluctuations do not affect it.

Advantage: You don’t need to pay an additional charge if there is a hike in lending rates.

Disadvantage: You will not benefit if the standard lending rates fall.

2. Floating Interest Rate

In a floating interest rate system, your standard rate of interest may vary due to the latest published rate (LPR) of the bank. This depends on many factors such as RBI’s monetary policy and lending rate revisions, the bank’s response to the revision, etc.

Advantage: You will have a reduced interest rate when the standard lending rates fall. Thus, you will save on interest charges if the rates fall.

Disadvantage: You will have to pay an increased interest rate if the standard lending rates go up, in the rare scenario. Lenders will charge a higher rate according to the increased LPR.

How to Calculate Home Loan EMI?

There are two ways through which you can calculate and know the EMI on your home loan. The first one is using an EMI calculator and the second one is using EMI Calculator Formula.

Use EMI Calculator

Most Indian banks and housing finance companies have Home Loan EMI Calculator on their websites. Using the EMI calculator, you can quickly calculate the interest amount applicable to your housing loan. Just you need to fill out the following details –

- Home loan amount

- Interest rate applicable

- Tenure of loan repayment

After filling out these details you may have to click on a button namely SUBMIT, CALCULATE OR APPLY now. Thereafter you will see the detailed breakup of your loan. For example,

Your Details:

Loan amount: Rs 20,00,000

Interest rate: 6.9% p.a.

Tenure of loan repayment: 20 years

Equated Monthly Instalments (EMI): Rs 15,386

The Breakup of the Total Amount

Principal amount: Rs 20,00,000

Interest amount: Rs 16,92,677

Total payable amount: Rs 36,92,677

Use EMI Calculation Formula

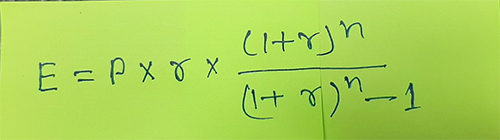

If you don’t have access to the internet to use the online home loan EMI calculator then again you can calculate the EMI. The second option is the EMI Calculation Formula. Yes, your home loan EMI can be calculated using the formula –

Where,

E = EMI (Equated Monthly Instalment)

P = Principal Amount

r = Monthly Rate of Interest

n = Number of months

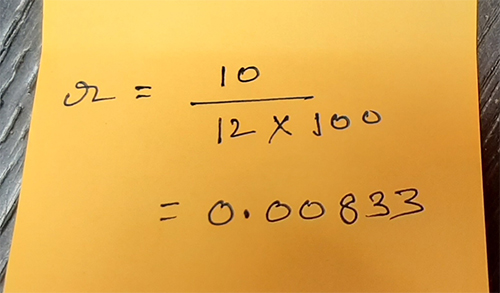

Example of EMI Calculation

Using the formula, the EMI will be calculated as:

Suppose you get a loan of Rs 1,00,000 at an interest rate of 10% p.a. for a period of 12 months.

Calculating the above expression gives,

E = 8792

Hence, your EMI will be Rs 8,792

If you get a home loan from a bank,

Effective Interest Rate (EIR) = Base rate/External benchmark rate + Markup

In case of HFCs or NBFCs,

Effecting Interest Rate (EIR) = PLR – Markup

Base Rate: This is the standard lending rate of the bank/lenders for all retail loans. The base rate is revised by the home loan lender from time to time.

Markup: Markup also called speed is the margin that is added to the base rate of a specific type of home loan. The markup may vary from one type to another.

External benchmark: As RBI directives, lenders are now bound to offer home loans linked to any of the external benchmarks such as RBI’s repo rate. The change in repo rate leads to a change in the home loan interest rate.

PLR: PLR stands for Prime Lending Rate. It is an internal benchmark of housing finance companies (HFCs) or non-banking financial companies (NBFCs). This component is used by lenders to offer home loans at floating or fixed rates.

Why You Always Need to Compare Home Loan Interest Rates?

A borrower has to pay a considerable amount of money as an interest loan on his/her home loan. The housing loan interest rate significantly influences the total cost of your house. More often than not, banks or housing finance companies offer loans of higher value and for a longer tenure. Hence, even a small difference in interest rate can significantly impact the total cost of your house, especially in long run.

For example, home loan interest rates are 6.75% in Citibank and 6.65% in Kotak Mahindra Bank. It seems that there is very little difference in the interest rates. Really? If you will analyze the total amount payable then you will see a significant difference.

Support you want to take a home loan of Rs 30,00,000 for 20 years. ABC bank offers you a home loan at the interest rate of 6.75% and XYZ bank offers you the home loan at the interest rate of 6.5%

According to ABC bank home loan interest rate of 6.75%

Total equated monthly installments (EMI) will be Rs 23,079 for 20 years

Total amount payable in 20 years = 20 x 12 x 23,079 = Rs 55,38,960

Total interest amount: = Rs 55,38,960 – Rs 30,00,000 = Rs 25,38,960

According to XYZ bank home loan interest rate of 6.5%

Your monthly EMI is Rs 22,367 at a 6.5% interest rate for 20 years

Total amount payable in 20 years (240 months) = Rs 53,68,080

Total interest amount: = Rs 53,68,080 – Rs 30,00,000 = Rs 23,68,080

You see that there is a huge difference between the total payable amounts. If you get a home loan with XYZ bank then your EMI is cheaper and you save Rs 1,70,880 in the total amount payable. So, it would be always a wise step to check and compare the home loan interest rates from different banks and housing finance companies.

Nowadays, the lowest home loan interest is being offered by HSBC Bank. Home loan interest in this bank is 6.64% p.a. You can also transfer your existing home loan to HSBC bank with a housing loan interest rate starting at 6.64 p.a.

Kotak Mahindra Bank is also offering home loans at very attractive rates. You can get a home loan from this bank starting at 6.65% only. Other affordable lenders are Union Bank of India, Bank of Baroda, State Bank of India, ICICI, LIC Housing Finance, Axis Bank, and HDFC bank. These all banks are offering home loans at interest rates of below 7% per annum. The lowest SBI home loan interest rate is 6.75% p.a for women borrowers applying for a housing loan of up to Rs. 30 lakh and through the YONO app. LIC Housing Finance is offering home loans at the interest starting at 6.90% p.a. If you consider Bank of Baroda for homes loans then you can get the same at the interest rate starting at 6.75% p.a.

Don’t Overlook Other Fees and Charges Related to Home Loan

If a person gets a home loan from a bank, he/she also has to bear several other fees and charges that might impact the total cost of the loan. Usually, prospective home buyers are more concerned about the home loan interest rates. Often, they overlook the other fees and charges related to home loans. You must be aware of the additional fees and charges before making any decision. Processing fees, CERSAI charges, and GST can impact the total cost of home your loan. One thing you must keep in mind is that some lenders might offer you a home loan at the same interest rates but may have different additional fees and charges. So, compare home loan rates and associated fees & charges as well before coming to any conclusion. Here are some of the fees and charges that may be applicable to your housing loan.

Application Fee: Lenders/banks charge an application fee to cover all the preliminary expenses they bear for conducting the verification.

Processing Fee: Most banks and housing finance companies charge a processing fee for a home loan. They levy a processing fee to cover the cost of credit appraisal. There are also some lenders that don’t levy processing fees.

Administrative Fee: There are certain banks that also charge an administrative fee. This fee is usually charged by the lender after the loan sanction. Citibank is one of the lenders that levy administrative fees.

CERSAI Charges: CERSAI stands for Central Registry of Securitisation Asset Reconstruction and Security Interest. It is the central online security interest registry of India. Lenders use the CERSAI website to check the pledged property is not claimed by some other lenders. For this process, they have to pay a nominal fee to CERSAI. For this reason, lenders collect this fee from borrowers.

Foreclosure or Prepayment Charges: Many borrowers prefer to pay their loans as soon as possible. It is more likely that a borrower will want to foreclose the home loan or prepay if they have excess money. Earlier, lenders levy foreclosure or prepayment charges. But now RBI had banned from charging borrowers with prepayment or foreclosure penalties on floating home loans. But on fixed-rate home loans, some lenders may still levy these charges.

Legal Fee: Lenders charge a legal fee as they have to engage firms to verify borrowers’ legal documents. Some lenders don’t charge a legal fee as it is included in the processing fee.

EMI Bounce Charge: Lenders levy EMI bounce charge when your home loan EMI is bounced due to insufficient funds in your bank account. Usually, lenders levy a penalty of Rs 5,00 in case of an EMI bounce. The penalty for EMI bounce may vary from one lender to another.

Overdue Charges on EMI: Lenders will levy an overdue charge on EMI if borrowers miss or delay timely payment of loan EMIs. Hence, borrowers must pay the loan EMIs on time to avoid the penal interest rates on the outstanding dues or overdue installments over the prevailing loan interest rates.

Rate Conversion Fees: Rate conversion or switching fees are levied by lenders when borrowers request to switch or reduce the existing interest rates. This fee varies from one lender to another. Usually, it goes up to 2% of the outstanding principal amount.

Repayment Mode Change Charges: When borrowers request their lenders to change their existing repayment mode during the loan tenure, they will be repayment mode change charges will be levied. Usually, this charge goes up to Rs. 500 for instance. The charge may vary from one lender to another.

Stamp Duty Fee: A stamp duty fee or franking fee is a tax levied by the state government on any form of monetary transaction involving the transfer of rights of a property. The fee varies from one state to another depending upon the factors like state laws, and type of property. There can be different stamp duty fees for residential and commercial properties.

Tax Benefits on Housing Loans

Have you ever heard about home loan tax benefits? Yes, you will have tax benefits on your home loan. The Government of India offers tax benefits on housing loans under the Income Tax Act of 1961. Due to this act, borrowers can save a considerable amount of money every year. Below is the table that will show you the tax benefits you can get on your home loan EMI payments.

Home Loan Tax Benefit 2021-22

| Section of Income Tax Act | Nature of Home Loan Tax Deduction | Max. Tax Deductible Amt. |

| Section 24(b) | Interest paid | Rs. 2 lakh |

| Section 80C | Principal (including stamp duty and registration fee) | Rs. 1.5 lakh |

| Section 80EE | Additional interest (for first-time homebuyers) | Rs. 50,000 |

| Section 80EEA | Additional interest (for affordable housing) | Rs. 1.5 lakh |

Note: In addition to Section 24(b) of the Income Tax Act, you can claim tax benefit on housing loan interest either under Section 80EEA or Section 80EE.

Eligibility Criteria of Getting Home Loan

Eligibility for obtaining a home loan varies from one bank/lender to another depending on varied loan schemes. However, there are a common set of home loan eligibility criteria that will help you access yourself whether you are eligible for a loan or not. Below are the common eligibility criteria for getting a home loan.

- Nationality: Indian Residents, Non-Resident Indians (NRIs), and Persons of Indian Origin (PIOs)

- Eligible Age Group: 21 – 60 years (for salaried)

- Eligible Age Group: 25 – 75 years (for self-employed)

- Credit Score: 750 and above

- Minimum Total Work Experience: 2 years for salaried

- Minimum Work Exp. with current organization: 1 year (for salaried)

- Minimum Net Monthly Income or Salary: Rs. 25,000 (varies across lenders and locations)

- Minimum Business Experience: 3 years in current business (for self-employed)

- Minimum Annual Turnover: Rs. 15 lakhs (for self-employed)

- Loan Amount: Up to 90% of property value

- The type and location of your property that you are buying

Documents Required to Apply for a Home Loan

If you are interested in getting a home loan as you want to buy your own home then you will have to furnish certain documents to your bank or lender. You will need to submit copies of certain documents along with the housing loan application form to your lender/bank. So, you must be well prepared for the required documents if you truly want to get a home loan from a bank or a housing finance company. The requirements of documents may vary from one bank/lender to another. However, there is a certain common document required for getting a home loan. Some of the documents you will need to submit for a home loan are: –

| Documents Required | Salaried | Self Employed |

| Housing Loan Application Form | Duly filled in and signed with passport size photographs | Duly filled in and signed with passport size photographs |

| Proof of Identity | Aadhaar Card, PAN Card, Driving License, Voter ID Card, Passport, and Govt. Issued ID Card | Aadhaar Card, PAN Card, Driving License, Voter ID Card, Passport, and Govt. Issued ID Card |

| Proof of Age | Birth Certificate, PAN Card, Employee ID Card (only for PSU/ Government employees), School/College Leaving Certificate, Passport, Voter ID Card, Driving License, and Aadhaar Card | Birth Certificate, PAN Card, School/College Leaving Certificate, 10th Class Marksheet, Passport, Voter ID Card, Driving License, and Aadhaar Card |

| Certificate and Proof of Business Existence | -NA- | PAN, Sales tax/ Excise/ VAT/ Service tax registration, Partnership deed, Trade license, certificate of practice, registration certificate issued by RBI, SEBI |

| Proof of Address | Bank Passbook, Election ID Card, Ration Card, Passport, Aadhaar, Utility Bills (Telephone Bill, Electricity Bill, Gas Bill, etc), LIC Policy Receipt) | Bank Statement, Utility Bills, Lease Agreement, TAN allotment letter, Voter ID Card, Passport, and LIC Receipt |

| Proof of Income | Form 16, 6 months latest salary slips, last 6 months bank statement, IT returns (ITR) of past 3 years, and Investment proofs (if any) | Last 6 months bank statement, Details of ITR of last 3 years, Balance sheet, Profit & loss account statement of the company/firm, Business licensed, and Details & proof of business address |

| Property Documents | NOC from society/builder, registered sales deed, allotment letter, detailed estimate of the cost of construction of the house, possession letter, latest property tax receipt, and approved building plan | NOC from society/builder, registered sales deed, allotment letter, detailed estimate of the cost of construction of the house, possession letter, latest property tax receipt, and approved building plan |

Note: The above list of documents required for applying for a home loan is indicative. Your lender might ask for additional documents.

Things to Remember Before Taking Home Loan

Buying a home can be one of the biggest events of everyone’s life. After all, the fun of living in your own home is something else. If you live in your own home then you have your own rights and liberties that you cannot in a rented home. So, getting a home loan can fulfill your dream of living in your own home. There are several banks and housing finance companies in India that are offering attractive housing loan schemes at affordable rates of interest. Home loan interest rates may/will vary from one lender to another. If you are confused and unable to decide which housing loan scheme is right for then you must take your time to research. Here are certain tips and suggestions that might help you in choosing the right housing loan scheme.

Compare Loan Interest Rates

You might like to compare the price of a washing machine because comparing the price will save you a few bucks. Exactly, you must compare the housing loan interest rates. It is imperative because even a marginal difference in the home loan interest rate will create a substantial difference in the total costs of housing loans. It is because, home loans are offered for a long tenure, such as for 20 to 30 years. Assume a bank is offering you a home loan scheme with the lowest rate of interest then you must not apply for it in a haste. Go through all the terms and conditions and try to find out why the interest rate is so low as compared to other housing loan schemes.

Check Lender’s History

If you wish to get a home loan from a bank or any other lender then make sure to scrutinize its history. You must not borrow money from an unknown untrusted lender. Getting a home loan from a trusted lender can result in a huge financial problem. One of the best ways to scrutinize lenders’ backgrounds is by checking their online reviews and ratings. You can also contact mortgage brokers or housing finance experts to find out information about any lender.

Maintain a Good Credit Score

Your credit score will also affect the housing loan rate of interest. If your credit score is below 750 then lenders/banks may refuse to give you the money. Or, lenders/banks may agree to give you land at a high-interest rate. On the flip side, maintaining a good credit score will help you get a home loan at an attractive rate of interest.

Understand the Applicable Fees & Charges

Before you choose a home loan scheme, you must understand the applicable fees and charges. There are several fees and charges associated with a housing loan such as application fee, processing fee, legal & technical fees, documentation charge, late fee, foreclosure fee, prepayment fee, CERSAI charges, EMI bounce charge, rate conversion charge, overdue charge, repayment mode change charge, stamp duty fee, etc. You must be aware of all fees and charges associated with your home loan. It is recommended to get the list of all the fees and charges in writing.

Make a Down Payment

Making a down payment while applying for a home loan will save you a considerable amount of money. The more money you pay as a down payment, the lower your EMIs will be. So, make sure to make a down payment when applying for a home loan.

Read The Fine Print

You must make yourself aware of the specific terms, conditions, restrictions, and limitations of the housing loan agreement and contract before you take money. It can take your time but it is imperative and protect you against any financial problem later.

How to Reduce Home Loan Interest Burden?

Paying EMIs for a home loan is one of the biggest responsibilities of a person’s life. As a borrower, you must be strict to pay the EMI on time to avoid penalties. Late EMP payment can also lower your credit score as a result you may get difficulties in any further financial transactions. But there are certain ways through which you can reduce the burdens of a home loan. Here are a few tips that might help you with that.

- Transfer of home loans to lenders with the lower housing loan interest

- Increase home loan EMIs. This can help you get rid of a home loan quickly.

- Make prepayment or part payment of a home loan. This will save you on home loan interest rate and can also reduce the EMI burden

- Make home loan down payment for lower EMIs

- Opt for a longer loan tenure to reduce monthly EMIs. In this case, the total rate of interest will be higher.

- Apply for a joint home loan. This will distribute the home loan burden among joint home loan borrowers. Also, there is a higher chance of loan repayment in this case.

Hmm it looks like your blog ate my first comment (it was super long) so I guess I’ll just sum it up what I submitted and say, I’m thoroughly enjoying your blog. I as well am an aspiring blog writer but I’m still new to everything. Do you have any points for novice blog writers? I’d really appreciate it.